SECURITY whose cash flows equal the difference between the cash flows of the collateralizing ASSETS and the collateralized obligations of a securitized TRUST. Characteristics of CMO residuals vary greatly and can be extremely complex in nature. An accreditation conferred by the Institute of Management Accountants that indicates the designee has passed an examination and attained certain levels of education and experience in the practice of accounting in the private sector.

The non technical term used by some to describe any cash or other property that is received in exchange of property that would be otherwise nontaxable. Individuals responsible for overseeing the affairs of an entity, including the election of its officers. The board of a CORPORATION that issues stock is elected by stockholders.

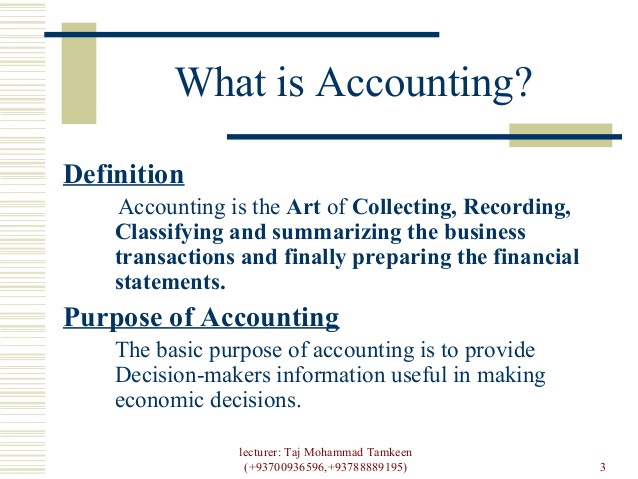

As you would expect, maths is the most useful subject to have when you’re applying for an accounting degree. Economics, statistics, finance, and business are all useful subjects too, as is displaying the right type of interests and talents in your other subjects. Accounting is a highly specialised subject, but is about much more than just numbers. It looks specifically at the daily flow of money in and out of a business, keeping an eye on the balance and avoiding any future challenges. Accounting is one of the backbones of the modern world, and the backbone of business. Behind every successful company is a skilled accountant – who understands how to use their knowledge of finance, mathematics, statistics, and economics to grow a business.

Following accounting standards

Method used in evaluating investments whereby the net present value of all CASH outflows and cash inflows is calculated using a given DISCOUNT RATE, usually required rate of return. Report issued by an ACCOUNTANT based on limited procedures that states that nothing has come to the accountant’s attention to indicate that the financial information is not fairly presented. BOND issued by a government or public body, the INTEREST on which is typically exempt from federal taxation. A significant deficiency or combination of significant deficiencies that results in more than a remote likelihood that a material misstatement of the annual or interim financial statements will not be prevented or detected. ACCOUNTING method of valuing inventory under which the costs of the last goods acquired are the first costs charged to expense. Acquisition of a controlling INTEREST in a company in a transaction financed by the issuance of DEBT instruments by the acquired entity.

After a taxpayer’s basis in property is determined, it must be adjusted upward to include any additions of capital to the property and reduced by any returns of capital to the taxpayer. Additions might include improvements to the property and subtractions may include depreciation or depletion. A taxpayer’s adjusted basis in property is deducted from the amount realized to find the gain or loss on sale or disposition. Person skilled in the recording and reporting of financial transactions.

- Tax professionals include CPAs, attorneys, accountants, brokers, financial planners and more.

- Also performed by others in connection with acquisitions and other transactions.

- You can also approach your application by showing your soft skills – like attention to detail, technical proficiency, and critical thinking.

- However, accounting firms such as Deloitte, Ernst & Young, KPMG and PricewaterhouseCoopers are renowned for tracking and managing public and private financial data.

- Portion of OVERHEAD costs allocated to manufacturing, by the application of a standard factor termed a BURDEN RATE or OVERHEAD APPLICATION RATE.

Accounting standards improve the reliability of financial statements. The financial statements include the income statement, the balance sheet, the cash flow statement, and the statement of retained earnings. The standardized reporting allows all stakeholders and shareholders to assess the performance of a business. Financial statements need to be transparent, reliable, and accurate. To illustrate double-entry accounting, imagine a business sends an invoice to one of its clients.

Charge levied by a governmental unit on income, consumption, wealth, or other basis. A percentage used to determine the amount of DEPRECIATION to be recorded each ACCOUNTING period for the straight-line method. E) Out of the Money option – Option granted with an exercise price above the market price.

Method of valuing ASSETS that results in adjustment of an asset’s carrying amount to its market value. Analysis of a nation’s economy as a whole, using such aggregate data as price levels, unemployment, INFLATION, and industrial production. This allows a credit for 20 percent of qualified tuition and fees paid by the taxpayer with respect to one or more students for any year that the HOPE SHCOLARSHIP CREDIT is not claimed. DEBTS or OBLIGATIONS owed by one entity (DEBTOR) to another entity (CREDITOR) payable in money, goods, or services. Transaction under which the LESSOR borrows funds to acquire property which is leased to a third party.

Margin of Profit

Double-entry accounting is also called balancing the books, as all of the accounting entries are balanced against each other. If the entries aren’t balanced, the accountant knows there must be a mistake somewhere in the general ledger. Financial accounts have two different sets of rules they can choose to follow. The first, the accrual basis method of accounting, has been discussed above. These rules are outlined by GAAP and IFRS, are required by public companies, and are mainly used by larger companies. A major component of the accounting professional is the “Big Four”.

For businesses, tax collectors, regulators and other oversight agencies want to see thorough and proper accounting records. If your business ever seeks investors or other shareholders, these agencies will review your accounting paperwork. For example, when you see a deal made on a TV show like The Profit or Shark Tank that later falls apart, it’s almost always because of accounting problems.

In addition, accounting makes it possible to create financial projections to plan for the future and anticipate sales and expenses. Without accounting, it would be incredibly difficult to gauge your business’s performance and whether it’s on track to meet its goals and obligations. Accounting is important as it keeps a systematic record of the organization’s financial information.

Collection of all ASSET, LIABILITY, owners EQUITY, REVENUE, and expense accounts. The amount that an investment will be worth at a future date if it is invested at compound interest. Transferable agreement to deliver or receive during a specific future month a standardized amount of a commodity. Method of ACCOUNTING and presentation whereby ASSETS and LIABILITIES are grouped according to the purpose for which they are to be used. A corporation which is not organized under the laws of ones territories or states.

Net Current Assets

As well as who is authorized to do what accounting task and what procedures and policies are in place. Public companies have to follow a set of rules set out by the government (this is the Securities and Exchange Commission in the U.S.). Some of these branches of accounting are important to small businesses.

Assists the FINANCIAL ACCOUNTING STANDARDS BOARD (FASB) and provides guidance on early identification of emerging issues affecting financial reporting and problems in implementing authoritative pronouncements. A refundable tax credit for eligible low income workers, subject to computations based on qualifying children and phase in and phase out income levels. Payment by a business entity to its owners of items such as cash ASSETS, stocks, or earnings. Rate at which INTEREST is deducted in advance of the issuance, purchasing, selling, or lending of a financial instrument. Also, the rate used to determine the CURRENT VALUE, or present value, of an ASSET or incomestream. Financial instruments whose value varies with the value of an underlying asset (such as a stock, BOND, commodity or currency) or index such as interest rates.

As an individual, you may use an accountant only for submitting your taxes, which is handled by certified public accountants (CPAs), who must pass an exam to prove their mastery of accounting. Accounting software allows you to do basic tasks such as tracking inventory, invoicing and payments, and generating reports on sales and expenses. It’s useful for small businesses and freelancers who don’t have the resources to hire an accountant or bookkeeper.

Without accounting, investors would be unable to rely on timely or accurate financial information, and companies’ executives would lack the transparency needed to manage risks or plan projects. Regulators also rely on accountants for critical functions such as providing auditors’ opinions on companies’ annual 10-K filings. In short, although accounting is sometimes overlooked, it is absolutely critical for the smooth functioning of modern finance.

Extinguishment of Debt

SEC requirement in financial reporting for an explanation by management of significant changes in operations, ASSETS, and LIQUIDITY. A DEBT that falls due more than one year in the future or beyond the normal OPERATING CYCLE, or that is to be paid out of noncurrent assets. A ratio used to indicate the number of times a COMPANY’s average inventory is sold during an accounting period. Process designed to provide reasonable assurance regarding achievement of various management objectives such as the reliability of financial reports. A professional organization made up primarily of management accountants. The sum of beginning inventory and the net cost of purchases during a period; the total goods available for sale to customers during an accounting period.

Price paid by a real estate limited partnership, when acquiring a lease, including legal fees and related expenses. Conveyance of land, buildings, equipment or other ASSETS from one person (LESSOR) to another (LESSEE) for a specific period of time for Accounting monetary or other consideration, usually in the form of rent. Any book containing original entries of daily financial transactions. Circumstance where loans in excess of ACCOUNTS RECEIVABLE are made against inventory in anticipation of future sales.

Process by which an insurance company obtains insurance on its insurance claims with other insurers in order to spread the risk. Agency responsible for keeping track of the owners of bonds and the issuance of stock. Replacing an old DEBT with a new one, often in order to lower the INTEREST costs of the issuer.

Excess of REVENUES received over costs relating to a specific transaction. Conventions, rules, and procedures necessary to define accepted accounting practice at a particular time. The highest level of such principles are set by the FINANCIAL ACCOUNTING STANDARDS BOARD (FASB).